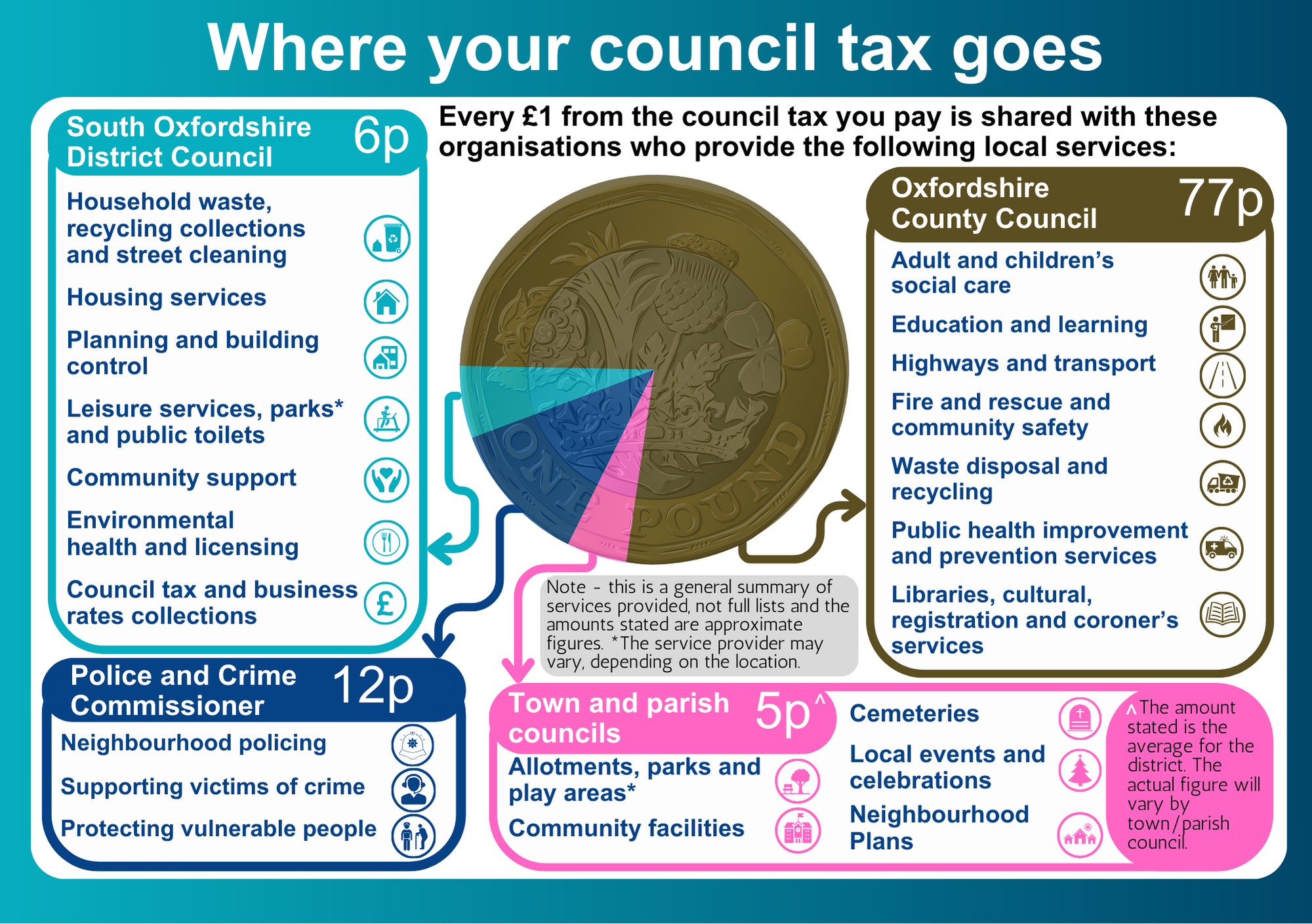

Where your council tax goes

Your council tax helps to pay for a vast range of public services provided across Oxfordshire. Please watch this short video or scroll down to find out more:

To find out more about the services provided by each organisation please click on the links below.

Oxfordshire County Council – find out more about how your money is spent on county services.

Thames Valley Police and Crime Commissioner (policing in the Thames Valley area) – for more information, please see the Police & Crime – Council Tax leaflet.

South Oxfordshire District Council – for more information please see our page on Where your money goes and the South Oxfordshire Council Tax leaflet.

Town or parish councils – the following town and parish councils have precepts of £140,000 or more and are therefore required to publish details of their expenditure:

- Benson

- Berinsfield

- Chalgrove

- Chinnor

- Cholsey

- Didcot

- Goring on Thames

- Henley on Thames

- Sonning Common

- Thame

- Wallingford

- Watlington

- Wheatley

These details relate to their specific areas and do not affect levels of council tax in other parts of the district.

Related Information

Council Tax Demand Explanatory Notes

Last year’s council tax information

- South Oxfordshire District Council – council tax leaflet 2024/25

- Oxfordshire County Council – council tax leaflet 2024/25

- Thames Valley Police and Crime Commissioner – council tax leaflet 2024/25

Contact us - Council tax

0345 302 2313

(Text phone users add 18001 before dialing)

South Oxfordshire District Council

Po Box 872

Erith

DA8 1UN